Ottawa Commercial Real Estate Market Overview - Q2 2023

Real Strategy Market Outlook: Q2 2023

In the second quarter of 2023 for the Ottawa-Gatineau region, we continued to experience increasing negative net absorption across the Ottawa-Gatineau market. 469,034 square feet returned to the vacancy pool in Q2 2023. This, combined with the amount returned in Q1 2023 totals 903,615 square feet in increased vacancy for 2023 year-to-date. This trend is likely to continue through

2023 and beyond as the Government of Canada continues to shed excess office space.

Download our printer-friendly market report PDF file: Click Here

Ottawa Commercial Real Estate Market Overview - Q1 2023

Real Strategy Market Outlook: Q1 2023

The net inflation rate continued to fall during the first quarter of 2023 (albeit slowly). Despite the progress, many economists are still predicting a mild economic recession this year. Although the Ottawa-Gâtineau region is fairing better economically than other major cities, people are not immune from the near-universal higher cost of living. Looking at the office market specifically, lower leasing demand continues due to the general uncertainty of will-they, won’t-they hybrid work models. Employers will need to stay attuned to and account for what their employees value most to figure out the optimal model and how that translates to square footage.

Download our printer-friendly market report PDF file: Click Here

Ottawa Commercial Real Estate Market Overview - Q1 2023

Real Strategy Market Outlook: Q1 2023

The net inflation rate continued to fall during the first quarter of 2023 (albeit slowly). Despite the progress, many economists are still predicting a mild economic recession this year. Although the Ottawa-Gâtineau region is fairing better economically than other major cities, people are not immune from the near-universal higher cost of living. Looking at the office market specifically, lower leasing demand continues due to the general uncertainty of will-they, won’t-they hybrid work models. Employers will need to stay attuned to and account for what their employees value most to figure out the optimal model and how that translates to square footage.

Download our printer-friendly market report PDF file: Click Here

Ottawa Commercial Real Estate Market Overview - Q1 2023

Real Strategy Market Outlook: Q1 2023

The net inflation rate continued to fall during the first quarter of 2023 (albeit slowly). Despite the progress, many economists are still predicting a mild economic recession this year. Although the Ottawa-Gâtineau region is fairing better economically than other major cities, people are not immune from the near-universal higher cost of living. Looking at the office market specifically, lower leasing demand continues due to the general uncertainty of will-they, won’t-they hybrid work models. Employers will need to stay attuned to and account for what their employees value most to figure out the optimal model and how that translates to square footage.

Download our printer-friendly market report PDF file: Click Here

Ottawa Commercial Real Estate Market Overview - Q3 2022

Real Strategy Market Outlook: Q3 2022

Rampant inflation and rising interest rates continued throughout the third quarter of 2022. In spite of a labour market that is still very hot, economists and business leaders are starting to believe a short-term cooling-off period may be on the horizon. Due to the adoption of hybrid work, the major trends in the office market have been tenant downsizing and flight to quality. This domino effect is only going to continue as the inevitable reality of the federal government’s portfolio rationalization looms ever closer.

Download our printer-friendly market report PDF file: Click Here

Ottawa Commercial Real Estate Market Overview - Q4 2022

Real Strategy Market Outlook: Q4 2022

After more downward pressure was experienced in the final quarter of 2022, Canada’s economic outlook continues to be precarious. Ottawa’s combination of public, tech, and professional services sectors makes the city resilient but not immune from impact. Speaking of the public sector, the government announced its return-to-office directive in December requiring public servants to be in-office two to three days a week (on par with hybrid work trends). With office tenants almost universally requiring less space, we expect increased vacancies to continue for the next 12-18 months.

Download our printer-friendly market report PDF file: Click Here

Ottawa Commercial Real Estate Market Overview - Q1 2022

Real Strategy Market Outlook: Q1 2022

Although Ontario has begun lifting restrictions, it’s been collectively acknowledged that we’re in the midst of a sixth wave of COVID cases. As a result, the return to the office is still something that’s very much in the air. Between this newest wave and hybrid work models that are being adopted, the road to the commercial real estate sector’s recovery will continue to be drawn out.

Download our printer-friendly market report PDF file: Click Here

Ottawa Commercial Real Estate Market Overview - Q2 2022

Real Strategy Market Outlook: Q2 2022

The trends of downgrading or right-sizing space, upgrading quality, and seeking locations with amenities and transit accessibility are still holding strong. Landlords are still opting for shorter leases, more lenient termination and sublease clauses, as well as better improvement allowances and outfitting periods. Class A property vacancies aren’t far off their historical average but the other property types are seeing almost record vacancy as their tenants ditch the old for new. That said, Class B and Class C landlords are now feeling the squeeze to put considerable amounts of investment into upgrading their properties to attract and retain tenants.

Download our printer-friendly market report PDF file: Click Here

Ottawa Commercial Real Estate Market Overview - Q3 2021

Real Strategy Market Outlook: Q3 2021

As the record hot summer was underway, many health restrictions were eased in Ontario (and most of Canada) and there existed lots of optimism towards a large scale return to work in the fall. As the third quarter came to a close however, more positive COVID-19 cases were being observed as a result of the Delta Variant and onset of a potential fourth wave.

Download our printer-friendly market report PDF file: Click Here

Ottawa Commercial Real Estate Market Overview - Q4 2021

Real Strategy Market Outlook: Q4 2021

The past year was a roller coaster to say the least. We began 2021 in the throws of another wave of the COVID-19 pandemic which then subsided as the summer approached and the vaccine rollout got underway. Restrictions were eased throughout this time and many organizations started to plan their return-to-work promgrams leaning heavily on a hybrid model.

Download our printer-friendly market report PDF file: Click Here

Ottawa Commercial Real Estate Market Overview - Q2 2021

Real Strategy Market Outlook: Q2 2021

Now halfway through 2021, the two main themes that are top-of-mind are vaccination rates and the reopening of the economy. In the first quarter of 2021, the Canadian economy grew by 5.6% and although there was a dip at the beginning of the second quarter in April, there were still many encouraging signs moving forward.

Download our printer-friendly market report PDF file: Click Here

Ottawa Commercial Real Estate Market Overview - Q1 2021

Real Strategy Market Outlook: Q1 2021

As we wrapped up the first quarter of 2021, the onset of the third wave in tandem with a vaccination rollout is certainly top of mind for many. For office users, it will likely take until the latter half of 2021 before we start to observe anything that resembles stabilization in the market since we are still very much in the midst of record-low tenant demand due to the pandemic impact on remote work. In the National Capital Region, many organizations are still figuring out their plans for office re-entry and a more permanent workplace reoccupation where hybrid work and activity based flexibility will be permanent pillars moving forward.

Download our printer-friendly market report PDF file: Click Here

Ottawa Commercial Real Estate Market Overview - Q4 2020

Real Strategy Market Outlook: Q4 2020

Throughout the final quarter of 2020, Ottawa saw increased office sublet availability (especially in the downtown core). Now more than ever, downtown tenants have lots of options at their disposal. This abundance of quality product, along with a soft market, may result in increased leasing activity in the coming quarters if office re-entry becomes more of a reality.

Download our printer-friendly market report PDF file: Click Here

Ottawa Commercial Real Estate Market Overview - Q3 2020

Real Strategy Market Outlook: Q3 2020

Throughout 20Q3, Ottawa rebounded strongly as the weather got nicer, case numbers improved, and net growth in job creation was observed. Despite the better case numbers and easing of restrictions during the summer months, the “return to work” was much slower than anticipated. As the transition from summer to fall occurred, the onset of the second wave resulted in an increased number of tenants choosing to temporarily vacate or sublease their space to reduce costs.

Download our printer-friendly market report PDF file: Click Here

Ottawa Commercial Real Estate Market Overview - Q2 2020

Real Strategy Market Outlook: Q2 2020

The global economic outlook has been severely impacted by the spread of COVID-19 and amplified by the sharp decline in oil prices. Central banks and governments have responded by lowering interest rates and offering stimulus measures. Even with lower interest rates providing some cushion for highly indebted households, the impact of the virus will keep consumers cautious and on-guard.

Download our printer-friendly market report PDF file: Click Here

Ottawa Commercial Real Estate Market Overview - Q1 2020

Real Strategy Market Outlook: Q1 2020

In the first quarter of 2020, all economies were profoundly affected due to the advent of COVID-19. The Ottawa-Gatineau economy however, is set to see employment growth around 2% as the region’s public service, high tech, construction, and retail/distribution sectors expand. Building off a 2019 GDP of 2.1% and employment growth of 1.3%, Real Strategy Advisors expects the Ottawa-Gatineau market to be less affected by the larger economic uncertainty abound.

Download our printer-friendly market report PDF file: Click Here

Ottawa Commercial Real Estate Market Overview - Q4 2019

Real Strategy Market Outlook: Q4 2019

The final quarter of 2019 in Ottawa’s office market saw a slight rise in overall office availability, as over 180K SF of primarily surplus government space came back into the marketplace. In the 12 months since Q4 2018, greater Ottawa’s office availability fell 0.6% to 8.9%. If there was a theme for 2019, it was marked by high demand by our local high tech sector, especially in Kanata. Looking forward to 2020, Real Strategy expects demand for quality office space to be very strong.

Download our printer-friendly market report PDF file: Click Here

Ottawa Commercial Real Estate Market Overview - Q3 2019

Real Strategy Market Outlook: Q3 2019

The office market in the National Capital Region continued to show strong demand, especially from the Federal Government and the local technology sector. Office users, both public and private, are demonstrating a strong preference for new or renovated space. This trend has lead to falling availability across the city as new space is gobbled up and the abandoned older office product is subsequently renovated. Overall office availability stood at 8.3% at the end of the third quarter, compared to 8.5% at the end of the second quarter. As we await the impact of a minority Liberal government on our local economy, Real Strategy is predicting another two-quarters of strong demand until such time that a new Federal budget is released.

Download our printer-friendly market report PDF file: Click Here

Ottawa Commercial Real Estate Market Overview - Q2 2019

Real Strategy Market Outlook: Q2 2019

Ottawa’s office market continued to experience significant demand for office space across all sectors. Overall office availability fell to 8.5% from 8.9% in the previous quarter. This represents six straight quarters of falling availability, a clear sign that the market is moving to favour landlords over tenants. Real Strategy is predicting availability to continue falling for the balance of the year until such time as the results of the Federal election are known.

Download our printer-friendly market report PDF file: Click Here

Ottawa Commercial Real Estate Market Overview - Q1 2019

Real Strategy Market Outlook: Q1 2019

Unprecedented leasing activity concentrated in downtown Ottawa and Kanata started greater Ottawa’s 2019 office market off with a bang! Greater Ottawa’s availability rate fell to 8.9% at the end of Q1 2019 compared to 11.3% from a similar time last year. This change was driven by the explosive growth of the cannabis sector following legalization as well as an exceptionally strong technology sector lead by companies such as Ford and Mitel. Additionally, the federal public service continued to increase its footprint in new modern space. Real Strategy is predicting that demand for office space may slow as we move closer to the Federal Election, for it is unclear whether public policies supporting growth in the NCR will continue should there be a significant change in political direction.

Download our printer-friendly market report PDF file: Click Here

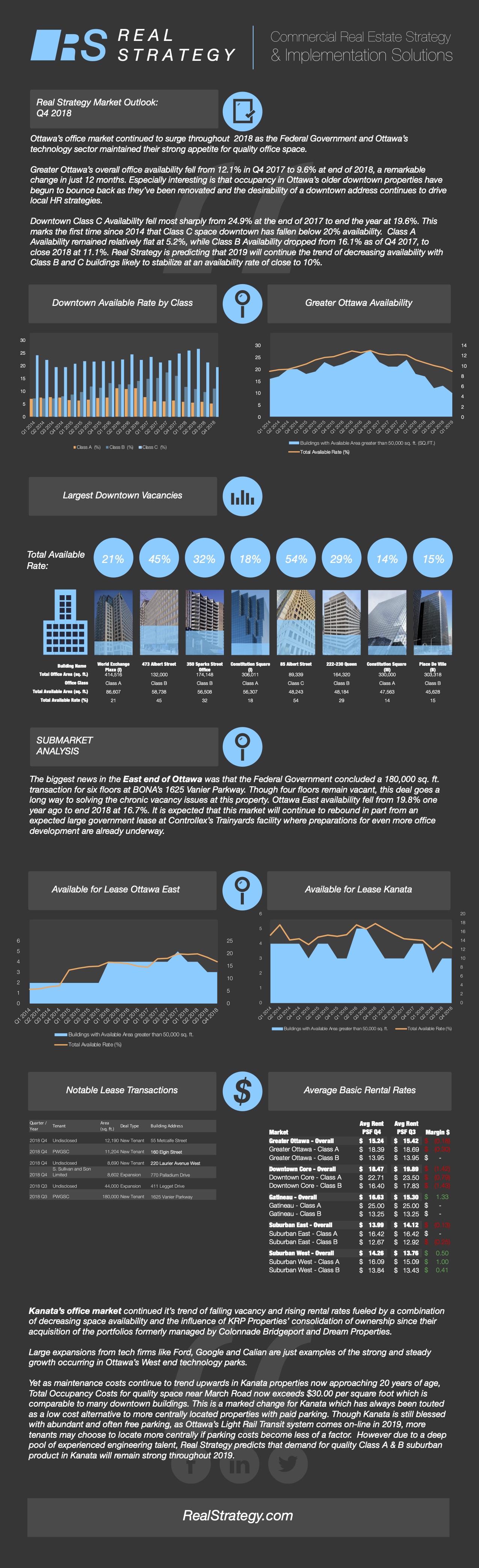

Ottawa Commercial Real Estate Market Overview - Q4 2018

Print PDF File: Click Here

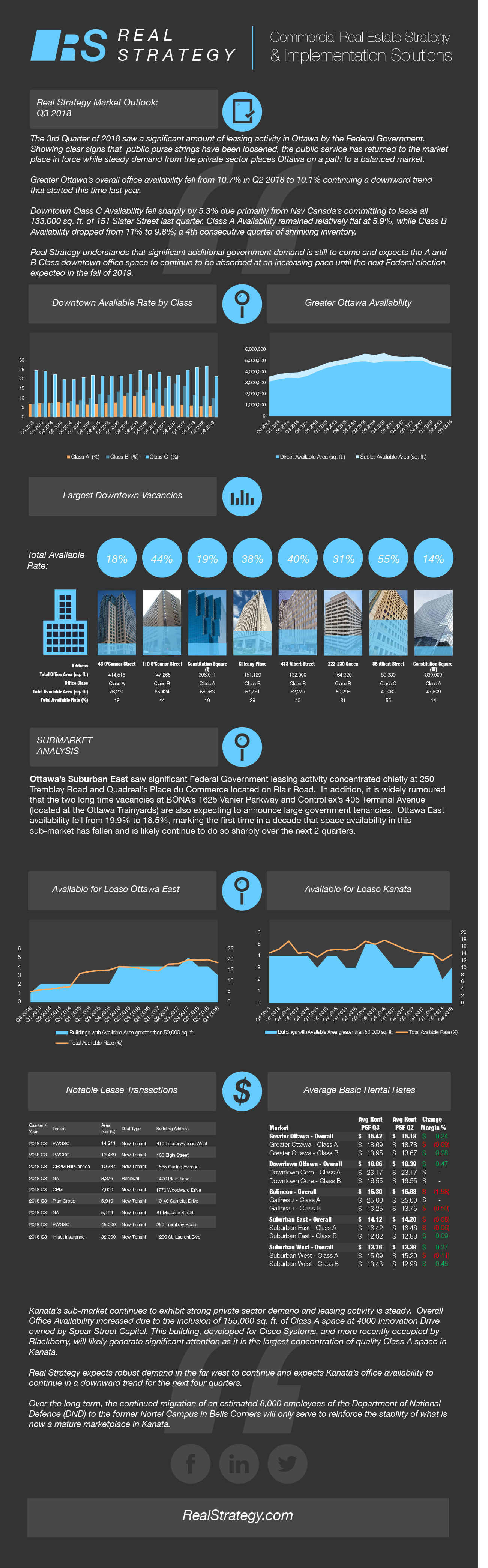

Ottawa Commercial Real Estate Market Overview - Q3 2018

Print PDF File: Click Here

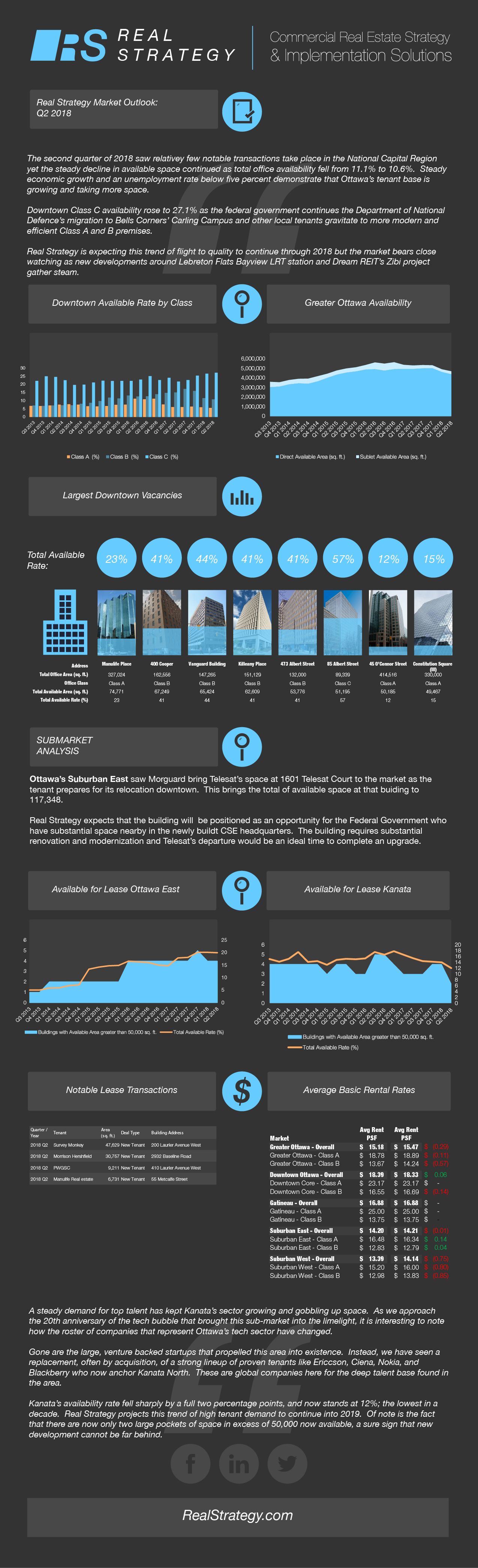

Ottawa Commercial Real Estate Market Overview - Q2 2018

Print PDF File: Click Here

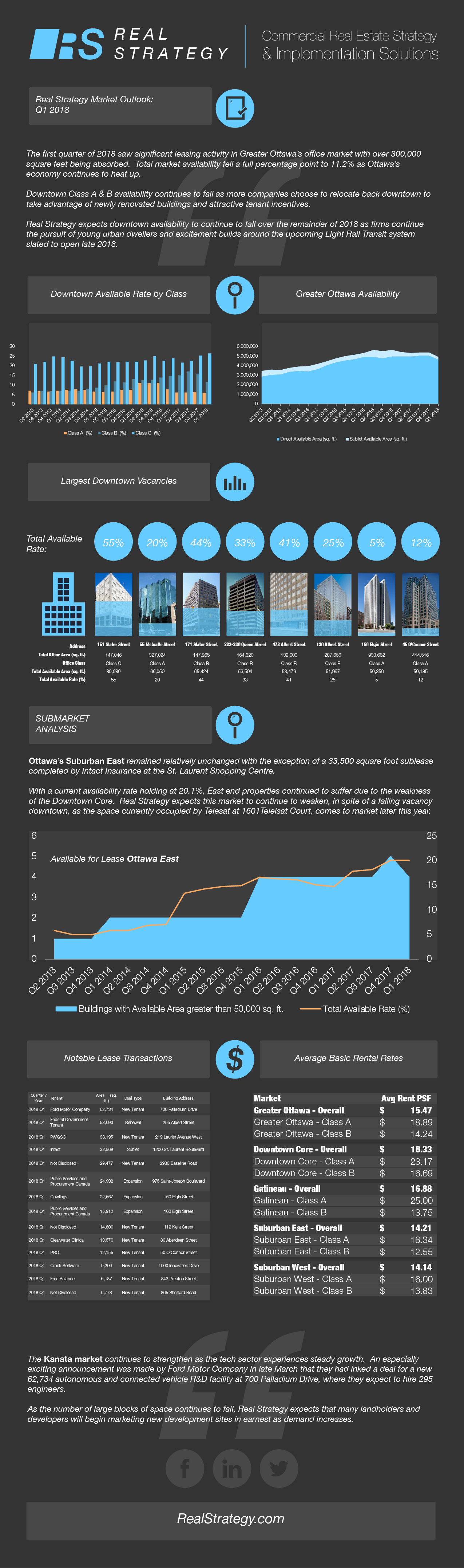

Ottawa Commercial Real Estate Market Overview - Q1 2018

Print PDF File: Click Here

Ottawa Commercial Real Estate Market Overview - Q4 2017

Print PDF File: Click Here